- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

With the advent of digital payments, credit cards and debit cards have become extremely popular forms of transactions. The increased spending limits, lower restrictions on minimum limits, and chances to avail of a wide variety of offers, debit cards are instruments of transaction found in everybody’s wallets these days. With the increased demand, banks and companies have also started circulating debit cards for teens. But which is the best card? Let us take a look at the best debit card for a teenager.

Today, most parents provide money to their teens not just in the form of cash, but even debit cards. Replacing hard cash with a debit card for teens is an excellent way of promoting financial literacy. In this article, we list the best debit card for teenager like Greenlight(Master card), GoHenry, BusyKid, Copper and many more. and its use and shortcomings.

Stay with us until the end and find your favorite best debit card for teenager!

Click here to Generate CVV Number.

Top Debit Card For Teens

We will discuss the best debit cards for teenagers in this section.

Greenlight (MasterCard)

An ideal card for parents, Greenlight offers various ways to regulate how their kid uses the card. Parents are even allowed to set retailer-specific spending limits. It comes with a monthly fee of $4.99 per month.

It comes with a monthly fee of $4.99 per month.

Benefits

- Greenlight does not charge any fee charged for ATM withdrawals.

- A savings account made with this card offers a savings boost of 1% to 2% for balances maintained up to $5000.

- A referral made by the cardholder or their parent yields a cash bonus for both the cardholder and the referred person.

- There is no lower age limit. Any person between 1 year to 17 years is eligible to avail of this card.

Shortcomings

- Only direct deposits are allowed. The cardholder cannot receive money from other digital platforms such as PayPal or Apple Pay.

- To be eligible for investing, the account requires an upgrade to the $7.98 monthly plan.

Visit: Greenlight(MasterCard)

See Also: SSN Generator | Free Social Security Number

GoHenry (MasterCard)

One of the most popular and best debit card for teenager, GoHenry is a colorful card that comes with innovative and interactive features to keep your child enthralled in the monetary scheme of things!  It comes with a monthly fee of $3.99 per month, and all persons between 6 to 18 years are eligible to use this card.

It comes with a monthly fee of $3.99 per month, and all persons between 6 to 18 years are eligible to use this card.

Benefits

- GoHenry is much more than just a debit card and contains specially designed interactive games that strive to teach financial literacy to young minds. Children get to play many games and receive rewards as well.

- A free trial of thirty days is in offer for users who wish to explore this card.

- Parents are allowed to create artificial tasks for their kids, allowing the kids to focus on a specific goal. GoHenry also offers regulatory features for parents, such as fixing a limit on spending, weekly limits, etc.

Shortcomings

- A fee of $1.50 for ATM withdrawals.

- Only direct deposits are allowed, and it isn’t possible to add money to the debit card via other digital platforms.

- Deposits are capped at only three times a day with a maximum upper limit of $500.

Visit: GoHenry(MasterCard)

- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

See Also: Valid American Express Credit Card Generator | AmEx Card Number

BusyKid (Visa)

Also known as the BusyKid Visa Prepaid Spend Debit Card, this is the go-to card for all those inquisitive teenagers exploring the pros and cons of the stock market. It comes with a monthly fee of $3.99 per month without any lower age limit.

It comes with a monthly fee of $3.99 per month without any lower age limit.

Benefits

- Cardholders are offered many ways to use their money through this card. You can save money with a parent-paid interest, use the card for daily transactions, invest in stocks using the BusyKid app or make charitable donations to places listed by BusyKid.

- Cardholders can buy stocks for a minimal cost of $10 only.

- Parents have to restrict the deposition of money, and any deposition into this card requires parental permission.

Shortcomings

- Parents do not have much control over how their children spend money as compared to other debit cards. It is advisable to use this card once your kid has understood the basics of financial literacy and is trustworthy when it comes to money.

- A fee of $1.50 for ATM withdrawals.

Visit: BusyKid(Visa)

See Also: Valid Visa Credit Card Generator | Generate Unlimited Visa Card Numbers

Copper (MasterCard)

While most cards discussed till now have equal focus on kids and teenagers, the Copper debit card is exclusively made for teens providing lesser restrictions and greater financial freedom.  The card comes with a zero monthly fee, and persons over 13 years are eligible for this card. From the POV of a teen, this has to be the best debit card for teenager.

The card comes with a zero monthly fee, and persons over 13 years are eligible for this card. From the POV of a teen, this has to be the best debit card for teenager.

Benefits

- The card has features with ample resources for a teen to expand their financial knowledge with the help of quizzes and reading material. Parents, too, are roped in to make these learning sessions more interactive.

- There is no monthly fee or ATM withdrawal fee charged.

- Promoting the habit of saving, Copper allows the cardholder to open many buckets where not just the cardholder but also family and friends contribute money.

Shortcomings

- Negligible parental control.

- A minuscule amount of interest. (0.001% APY).

Visit: Copper(MasterCard)

See Also: What is a CVV Number? Find CVV or CVV2 Number Under 30 seconds

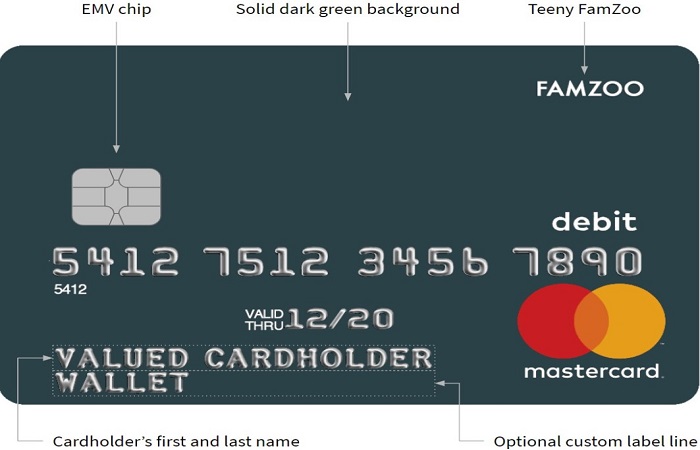

FamZoo Prepaid Card (MasterCard)

FamZoo card is one of the best debit card for teenager. It is a school that teaches kids the importance of saving and utilizing money effectively. It comes with various modules on financial literacy that include self-made goals, tracking of money spent, etc. There is no age limit set for this card, and it comes with a monthly fee of $5.99 per month.

There is no age limit set for this card, and it comes with a monthly fee of $5.99 per month.

Benefits

- Many courses imbibe financial literacy and provisions providing mock loans to children to let them understand how to save and spend.

- The account is in three types to make it easy for children to handle money.

- Account for spending

- Savings Account

- Account returning

- There is no upper limit on depositing money into the account.

Shortcomings

- Relatively high monthly fee of %5.99 per month.

- While there is no upper limit on deposits, there is definitely a restriction on how the money should be deposit. A deposition is available only via GreenDot or MasterCard re-power location.

Visit: FamZoo Prepaid Card (MasterCard)

See Also: Valid MasterCard Credit Card Generator | Unlimited MasterCard Numbers

- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

FAQ’S

The minimum age for a debit card depends completely on the company/bank issuing the debit card. Most debit cards made nowadays for kids and teens do not have a lower age limit but come with an upper age limit of 18 years. In today's dynamic world, financial literacy is the need of the hour. It is pertinent to make children aware of the ways of spending. Further, teen debit cards come with parental controls, so there is little room for any suspicious activity. This article is themed on the 'best debit card for teenagers'; thus, it is always advisable to provide your child with a debit card when they come of age. Pre-teens and teenage would be an ideal age for issuing a debit card. Providing these cards to children when they are very young could be counter-productive. Since spending and saving are more or less regulated via parental controls, the teen may not really learn how to spend money. However, every teen's debit card offers many ways to learn and implement financial literacy. This involves investing, learning how to save, setting self-made goals, etc. Financial literacy is the biggest benefit of having a teen debit card.When it comes to teens, how old do you have to be to get a debit card?

Is it advisable to give debit cards to teens?

What would be the ideal age for a child to use a debit card?

Which is the biggest benefit of a teen debit card?

Conclusion

Thus, we have found the various uses of a teen debit card and why one should use them. Parents should stay vigilant and go through every detail before issuing a debit card for their teen.

We hope you have found our article effective and got a glimpse into the best debit card for a teenager!

Want to learn how to generate a dummy credit card? Click here!