- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

This content belongs to Credit Card Validator & the process to validate or check any credit card detail.

Credit Card Validator

As you already know enough information about generating credit card numbers of various companies like Discover, American Express, JCB, MasterCard or Visa but how do you know that the card number which is generated through these websites is valid or not?

Enter Credit Card Number to Validate

Resulting details on the right side for desktop and below for mobile

Validation Result

| Card Type : | Not Specified |

| Card Number : | ****************** |

| Validation Test | ********* |

| Result | ********* |

The details associated with the card number are not going to be true as they are always chosen at random. However, we assure you to provide 100% valid credit card numbers with the help of Luhn Algorithm. But, if you do not trust and want to cross check once that the credit card number that you have got using our generator is valid or not then you can use the Credit Card Checker which is being provided by CardGenerator.io.

What Exactly the Credit Card Validator Checks?

The credit card validator check the credit card number that you provide and give back a valid result which will be carefully analysed and reviewed for an accurate Major Industry Identifier that is MII code. Further, you know that how it can be recognized by matching the prefixes in the credit card number, the IIN code and PAN number along with the checksum. The validator of the CardGenerator.io evaluates cards for MasterCard, Discover, American Express cards and JCB cards also.

Most of the credit card generators have some rules predefined to validate the credit card numbers and they go through them serially and check the following:

✅ Luhn Algorithm: – The validator is designed in such a way to ensure that the credit card number that is entered passes the Luhn algorithm to prove itself to be a valid credit card number.

✅ Major Industry Identifier: – It is the first digit of the credit card number.

✅ Issuer Identification Number: – It consists of the next six digits.

✅ Personal Account Number & Checksum: – Last seven digits include 6 digit personal account number and a 1 digit checksum.

How Credit Card Validation is Processed?

We at CardGenerator check for the following:

✅ First Digit – Major Industry Identifier

✅ Six Digit – Issuer identification number

✅ Seven Digit – Personal Account Number and Checksum

- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Instructions to Use Credit Card Validator or CC Checker

1. Let the validator page load completely, when it is loaded, you will see a box which says to enter the credit card number that you wish to validate.

2. Write the full credit card number on the space given and then click on the button saying Click to Validate.

3. As soon as you click on it you will see that the logo of the company to which the credit card belongs will be highlighted in the rest will be hidden.

4. Also below that, you will get a section of results, where the result of the validation process is displayed.

- Luhn Algorithm: – This will tell you that the card number is passed the validation test of the Luhn algorithm hence is entirely valid.

- MII Number: – It will tell by the first digit that which company your card actually belongs to.

- IIN Number: – This will tell the IIN code in the credit card number.

- PAN & Checksum: – This will differentiate the six digits personal account number and a single digit checksum.

This proves that the credit card number you have entered is a valid credit card of that particular company.

How Does the Mod 10, Modulus 10 or Luhn Algorithm Work?

A significant question that arises is that how the mod 10 algorithm or which is also known as the Luhn algorithm works and how does it validate the credit card number to be real?

Basically, the Mod 10 algorithm is a simple formula to check checksum and is a simple way to validate a majority of identification numbers like the credit card numbers, IMEI numbers, Canadian Social Insurance number, Greek social security number (AMKA) and National provider identifier number of US.

History of Luhn Algorithm

This algorithm was created by Hans Peter Luhn who’s an IBM scientist and is described in the US patent no. 2,950,048. It was filed on 6th of January in 1954 and was granted on 23rd of August in 1960.

Working of Luhn Formula

Let us understand the working of the modern algorithm by taking an example.

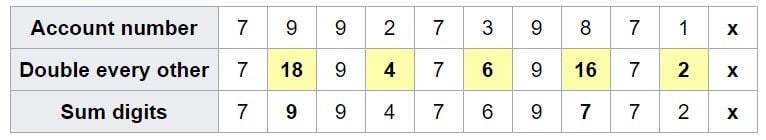

1. Choose a random account number like here we choose 7992739871. Add a check digit at the end of the account number, making it to be 7992739871X.

2. Add the details in a table as mentioned below:

- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

3. Now, sum of all the digits in the third row will be 67+x.

4. The check digit i.e. x is obtained by calculating the sum of non-check digits & then computing 9 times that value modulo 10 i.e. (in equation form, ((67 × 9) mod 10)). So, in short:

✅ Compute the sum of non-check digits i.e. 67.

✅ Multiply it by 9 (603).

✅ Unit digit is the check digit. Thus, x=3

5. Thus, after we attain the check digit, the valid account number is read as

79927398713.

Is This Online Credit Card Validator Tool Safe to Use?

Of course, Yes! the credit card validator checks for the Major Industry Identifier, Personal Account Number and Issuer Identification Number which is used just to validate and tell you that the credit card number that is you and that is valid or not. You can find the details information about MII in the table given below:

| MII Digit | Category |

|---|---|

| 0 | ISO/TC 68 and other industry assignments |

| 1 | Airlines |

| 2 | Airlines, financial and other future industry assignments |

| 3 | Travel and entertainment |

| 4 | Banking and financial |

| 5 | Banking and financial |

| 6 | Merchandising and banking/financial |

| 7 | Petroleum and other future industry assignments |

| 8 | Healthcare, telecommunications and other future industry assignments |

| 9 | For assignment by national standards bodies |

So according to the table:

✅ 4 for Visa – Banking and financial

✅ 5 for MasterCard – Banking and financial

✅ 3 for Discover card – Travel and entertainment

We Do Not Store Credit Card Numbers

Also, our website do not store any data which means none of the credit card numbers that you enter is saved. Because of security reasons and copyright issues these websites are not allowed to collect any credit card number that is entered by the customer itself. Thus, this Credit Card Validator is proved to be a safe tool.

FAQ’s

What is a Credit Card Validator?

To begin with, a Credit Card Validator employs various algorithms and validation methods. These algorithms consider the card's issuer identification number (IIN), length, and check digit.

How does a Credit Card Validator determine if a credit card number is valid?

To verify a credit card number's legitimacy, the Credit Card Validator makes use of predetermined rules and mathematical algorithms. It examines the number's length, prefix, or IIN. Further, performs a calculation known as the Luhn algorithm to verify the accuracy of the check digit.

Are Credit Card Validators accurate in determining the validity of credit card numbers?

Yes, Credit Card Validators are generally accurate in validating credit card numbers. They follow the rules and patterns established by credit card companies and adhere to industry standards. It can also check if sufficient funds are available for a transaction.

Are there any limitations or considerations when using a Credit Card Validator?

While Credit Card Validators are practical tools, they have limitations. For instance, they cannot verify the legitimacy of a credit card or detect if it has been reported stolen. Moreover, some validators may not support certain regional or specialized card types. It is vital to consult the documentation or guidelines the specific validator provides to understand its capabilities and limitations.

Contents