- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Many users are switching from using credit cards and debit cards to prepaid debit cards. It is because of the ease of obtaining a prepaid card without needing a bank account or a minimum bank balance. Prepaid cards are cheaper and offer much more rewards than regular cash payments. The only hindrance to a prepaid debit card is the constant need to reload it using various methods, which sometimes involve fees. We have made a list of prepaid cards for you to select from any reloadable prepaid cards with no fees!

Credit cards offer cashback and rewards but come at a higher cost. Debit cards come at a lower cost; however, the rewards are insignificant. In such a scenario, a prepaid debit card fits perfectly, satisfying both objectives, being a low-cost card and offering rewards and cashback. In this article, we take a brief look at the available prepaid cards and ascertain the best reloadable prepaid card. Learn how to generate a valid American Express Credit Card!

Don’t stop right here! Continue reading to delve into the business of prepaid debit card banking! Check out this article if you want to know whether your credit card number is valid or not.

List Of Reloadable Prepaid Debit Cards With No Fees

At the outset, we would like to clarify that it is almost impossible for a prepaid debit card or a bank/company issuing a prepaid debit card to charge you no fee. There is always some charge applicable that the user must pay. We look at those cards that charge the least fee for reloading purposes to fall into the no-fee reloadable debit cards category.

See Also: How Often Do Credit Card Frauds Get Caught

Bluebird By American Express (American Express)

Bluebird, without any doubt, is currently the number one prepaid debit card in the market.

It comes with the fine balance of imbibing financial literacy and offering some benefits to its users. If you want to produce visa credit card in bulk, click here

Fees Charged

- Bluebird offers multiple options to load money into it. Deposits made via online/direct ACH transfers or checkout registers at Walmart come with no fees.

- No fees are levied if users use Mobile Check Capture by Ingo Money. However, it takes up to ten days for processing.

- Free transfers can take place amongst family members.

- There are no monthly fees.

- When using MoneyPass ATMs, withdrawals from ATMs are free of charge.

Other Benefits

- Bluebird card coordinates with the American Express App, which helps unlock various features.

- Cardholders can explore many resources on the App that talk about financial literacy, financial independence, and fiscal responsibility.

- Short-term goals, monthly spending, and methods to improve savings are part of the card and the App.

- Cardholders stand a chance to purchase early-bird tickets to grand concerts and festivals.

- The card provides roadside assistance at all times.

- There are no monthly fees.

Shortcomings

- An ATM withdrawal at a non-MoneyPass ATM comes with a fee of $2.50.

- At non-network establishments, there is a $3.95 cost for cash reloads.

See also: Valid MasterCard Credit Card Generator | Unlimited MasterCard Number

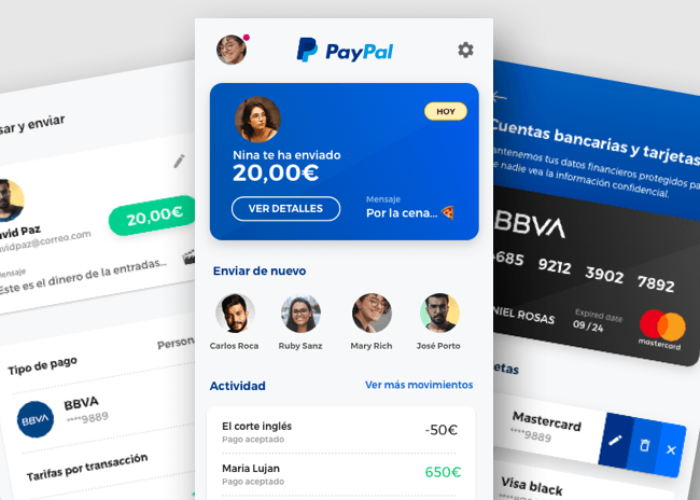

PayPal Prepaid MasterCard (MasterCard)

The ideal option for people is PayPal accounts. This card has a special place in the list of reloadable prepaid cards with no fees.

- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

It provides numerous advantages at a comparatively low cost for cash reloads.

Fees Involved

- Direct transfer from a PayPal account is free of cost.

- Mobile check deposits are also free. They, however, may take time to process. Check deposits are free, albeit a 1% fee may be added for expedited service.

Other Benefits

- This is the best card for users with a PayPal account as it helps in free direct transfers, and users can alter many features using the PayPal app.

- The card comes with FDIC insurance and offers a 5% APY for deposits up to $1000 to PayPal account holders.

- Miscellaneous benefits include referral programs, cashback, and discounts on bill payments.

Shortcomings

- A high monthly fee with no waiver provision.

- ATM withdrawals attract a fee of $2.5.

- Foreign transactions attract a fee of 2.5%.

- A deposition made via the Netspend network attracts a charge of somewhere between $2 to $3.95.

See also: Valid Visa Credit Card Generator | Generate Unlimited Visa Card Number

American Express Serve (American Express)

Working on similar lines as that of Bluebird, the Serve card is extremely cost-effective regarding cash reloads and money transfers.

If one were to draw up a prepaid card company list, the mention of American Express would occur multiple times.

Fees Charged

- There is no ATM withdrawal fee at in-network locations.

- A deposition of $500 waives off the maintenance fee.

- Online payments and check cashing are completely free.

Other Benefits

- Serve card coordinates with the American Express App, which helps unlock various features.

- Cardholders can explore many resources on the App that talk about financial literacy, financial independence, and fiscal responsibility.

- Short-term goals, monthly spending, and methods to improve savings are part of the card and the App.

- The card provides roadside assistance at all times.

Shortcomings

- An ATM withdrawal at a non-MoneyPass ATM comes with a fee of $2.50.

- At non-network establishments, cash reloads cost $3.95.

- There is a 2.7% foreign markup fee.

Read RBL Credit Card Review.

Movo Virtual Prepaid Visa Card (Visa)

A newer entrant into the reloadable prepaid cards with no fees.

Movo is perfect for the new generation trying to save on unnecessary costs and learning how to save.

- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Fees Charged

- There is no ATM withdrawal fee at any ATM authorized to accept Visa cards.

- A direct deposit or deposit via PayPal charges no fee.

- There is no monthly fee levied.

Other Benefits

- Movo card coordinates with the Movo App, which helps unlock various features.

- Direct Bitcoin transfers within the US are allowed.

Shortcomings

- If the account remains inactive for over three months, Movo charges a fee of $4.94 from the subsequent month till the account becomes active.

See also: Valid American Express Credit Card Generator | AmEx Card Number

Chime Credit Builder (Visa)

They are fiercely competing with Bluebird for the top place in the prepaid card market.

Chime Credit Builder is the most attractive of all the reloadable prepaid cards with no fees.

Fees Charged

- The monthly fee charged is zero.

- There is no interest fee.

- There is no fee charged for cashing checks and no requirement to maintain a minimum-security deposit.

- As well as no ATM withdrawal fee at in-network locations.

Other Benefits

- 24/7 assistance online and via call.

- Chime coordinates with its App, which helps unlock various features.

Shortcomings

- There is no provision of rewards or points.

- The user must open a Chime account to obtain the card.

- There are negligible chances of an account upgrade on the card.

See also: Valid JCB Credit Card Generator | Generate Unlimited JCB Card Number

FAQs

Are prepaid debit cards better than regular debit cards?

Prepaid debit cards do not come with the constraints of having a bank account and are easier to obtain. Regular debit cards are required to be connected to a bank account. In a prepaid debit card, however, there is a constant requirement for fund infusion.

What is the eligibility to obtain a prepaid debit card?

Since prepaid debit cards do not require a bank account, the eligibility conditions are slightly relaxed. Even teenagers without a bank account are eligible for such a card.

Are prepaid debit cards safe?

Prepaid debit cards are completely safe. The last chance of fraud is with prepaid debit cards as you do not feed a lot of personal information to purchase these cards, and the money loaded is also relatively low.

How are prepaid debit cards better than cash payments?

Prepaid debit cards' main advantage is that you can use them to make online transactions. Further, prepaid debit cards reward a user with cashback and bonuses when they are used for certain purchases.

Conclusion

With this, we have concluded our list of the best reloadable prepaid cards with no fees. Take a good look and select the card of your choice!

Find out more about Cards below:

Check out the MasterCard Credit Card generator!

Contents