- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

The world is changing drastically from all angles of life. From technology, business, and finance, there is a booming growth of technologies and services. All of these aim to improve the lifestyle of people like us. Movo Digital Prepaid Visa Card has a similar goal that makes banking, money transfer, and more a piece of cake.

But how practical is the movo digital prepaid visa card? Does it serve the purpose of a normal debit card? Is it secure to use a card with your money without an actual bank or governing institution looking after it? Movo has introduced a new age to digital banking and cryptocurrency. With Movo, you’re not only getting a seamless, no-contact option for digital banking, but it also keeps in check with crypto money.

Continue scrolling through here to get a movo virtual prepaid visa card review and decide if you’d get a card for yourself.

See Also: Best Credit Cards With The Lowest Forex Markup

What is Movo Digital Prepaid Visa Card?

MOVO introduces on-demand online banking with a new twist. Its goal is to enable tier customers as they securely receive money. But that is not just it. They can also spend their money or, if feeling generous, send money. All of this from the convenience of a mobile phone, even if you don’t have an existing bank account. With a Movo account, you can have contactless payments with movo digital cash.

Teenagers and young millennials lean more toward the world of crypto as we progress. Now, investment is not limited to stocks and mutual funds. People are also looking at crypto coins with great financial potential. Movo digital prepaid visa card is great for parents who want to give financial freedom to their children. Parents have the option to add the desired amount they think is suitable for their children. And the child can learn about good financial habits while making purchases. The drawback, however, is a lack of parental monitoring of these transactions. Movo is for users who are good with technology and like something that deviates from normal banking methods. Hence, teenagers are the best choice, and you should go and sign up for a movo account today! Even if you’re someone who is not good with digital banking or technology. It is relatively easier to operate on the Movo app. One just needs a little practice on the app to learn its ropes.

Visit: MOVO

See Also: Dummy Credit Card Generator

How is Movo Digital Banking helping you?

The MOVO Digital Prepaid Visa Card is mostly aimed at young adults. Although that doesn’t mean anyone above that can’t use Movo. In fact, the app has a lot of banking features for adults and parents. This makes banking easier and transactions flawless. If you are under 18, you can operate a Movo Bank account using your parent’s card. With a Movo bank, you learn your fiscal responsibilities and how to spend wisely.

In fact, the app has a lot of banking features for adults and parents. This makes banking easier and transactions flawless. If you are under 18, you can operate a Movo Bank account using your parent’s card. With a Movo bank, you learn your fiscal responsibilities and how to spend wisely.

See Also: Valid Diners Club Credit Card Generator | Generate Unlimited Diners Club Card Number

Seamless Digital Banking with Movo Banking:

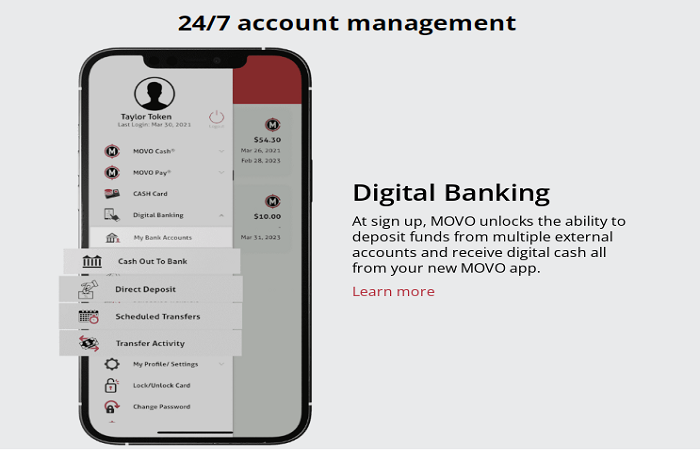

You start your journey with Movo banking with a Movo virtual prepaid visa. You can switch to change to a physical card later on. The Movo Digital Prepaid Visa Card is accessible across all banks for physical, online, or other transactions. Any place that accepts a Mastercard will also accept Movo cards.

- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Users can also make cards for MOVO Digital CASH. These are entirely digital cards and differ from the primary debit card linked to an account. These contain unique card numbers that can only be used once. Many MOVO cardholders decide to buy Cash cards to protect their account and the money in them. Especially during large transactions or when you don’t want to be charged. Getting a subscription that renews automatically is one of the examples provided by MOVO.

See Also: Valid American Express Credit Card Generator | AmEx Card Number

Save Money through Movo Digital Prepaid Visa Card

A Movo Digital Prepaid Visa Card is a prepaid card. With prepaid cards, you have the liberty to top it up with the desired amount of money that you’d like to spend. This allows you to limit your bad spending habits. With a normal bank account, all your cash is stored in one place. Hence, it is hard to control your spending urges. With a movo digital prepaid visa card, however, you can change that by only adding the limited money you will spend. Although, you have to bring yourself’s resolve not to add money beyond your spending limit.

With a normal bank account, all your cash is stored in one place. Hence, it is hard to control your spending urges. With a movo digital prepaid visa card, however, you can change that by only adding the limited money you will spend. Although, you have to bring yourself’s resolve not to add money beyond your spending limit.

See Also: Valid JCB Credit Card Generator | Generate Unlimited JCB Card Number

Crypto and Cash with Movo Digital Banking

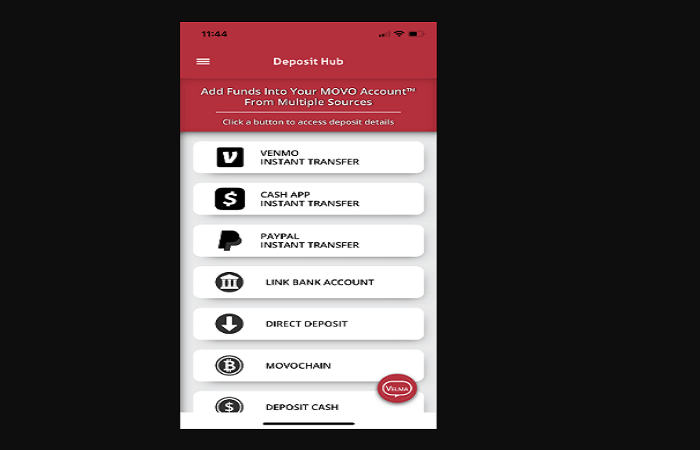

Movo Digital Banking has another cool, quirky perk to it called the Movo Chain. This is exactly what makes Movo better. Teenagers are heavily interested in crypto nowadays. With the Movo chain, one can easily turn crypto money into USD. The money can be sent to someone else through their contact details. Or one can load it up on their debit card.

Some of the crypto coins that are supported by this platform include Bitcoin, Ethereum, Doge Coins, USD Coin, BUSD, and more. They must then provide recipient information. At this stage, they might choose to send all or a portion of the money to a friend or themselves. After that, they enter the sender’s details and verify the transfer.

See Also: What is a CVV Number? Find CVV or CVV2 Number Under 30 seconds

How can Parents use Movo?

Parents can use MOVO accounts for ACH bank transfers. Or other normal banking procedures one expects, such as cash deposits, check deposits, or even direct deposits. Account opening does not require a minimum deposit and complete registration. Direct deposit transfers and ACH transactions are not subject to any daily cash deposit cap of $500.

Account opening does not require a minimum deposit and complete registration. Direct deposit transfers and ACH transactions are not subject to any daily cash deposit cap of $500.

The most that can be supported by this account is one physical and one digital debit card.

See Also: SSN Generator | Free Social Security Number

- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

How to open a Movo Account?

There are no monthly maintenance fees, direct deposit transfer fees, cash deposit fees, or activation fees. The physical card fee is $5.95, and the inactivity fee is $4.95. Refused ATM withdrawal fee is $0.50. POS PIN debit purchase fees of $0.50 + 3%, and MOVO Chain transfer fees of $1 + 2%.

The physical card fee is $5.95, and the inactivity fee is $4.95. Refused ATM withdrawal fee is $0.50. POS PIN debit purchase fees of $0.50 + 3%, and MOVO Chain transfer fees of $1 + 2%.

See Also: Valid Discover Credit Card Generator | Unlimited Discover Card Numbers

What are some Drawbacks of Movo Digital Prepaid Visa Card?

Movo claims that their aim in creating a new-age digital banking solution is to target teenagers. This allows young adults to get their first approach towards banking, cash, and more. They learn fiscal responsibility. However, the biggest setback created through this is the lack of guidance.

While it is true that children under 18 can create an account on Movo, the responsibility of topping it up with cash is with the parents. Movo, however, provides no aid to parents. They can just top up the movo debit card for their children. There is no option to limit spending. You can not get push notifications or keep track of where your child is spending all their money.

This puts the brand back by a few because although Movo Digital Prepaid Visa card is a new and fresh approach to traditional banking, it needs more transparency. Even with traditional banks that allow children’s accounts, they give some monitoring rights to parents to look over their children’s fiscal activities.

See Also: Credit Card Validator

FAQs (Frequently Asked Questions)

Is there any maintenance charge for a Movo Digital Account?

There are zero maintenance charges with a Movo account.

How is customer satisfaction with movo digital prepaid visa card?

Although the concept and card itself work fine. Customers had had complaints about crashing the movo app, sometimes being locked out of their account, and poor customer service when they got in contact.

Is it safe to use Movo Digital Banking?

Through member FDIC Coastal Community Bank, each MOVO account is FDIC insured up to the maximum of $250,000.

Can children below the age of 18 have a Movo account?

Children under 18 can use a Movo account. However, the parents have the responsibility to top up the cards with cash.

Conclusion

An excellent prepaid debit card overall, along with some intriguing benefits like crypto trading and one-time digital cards. This card provides good security and accessibility features. It will work best for those who desire a fully digital, spending-focused banking experience and less well for those who prefer a traditional checking account or an account with additional family-friendly features.

However, a card aims to help teens with financial responsibilities. It gives a wrong message about being financially responsible. As a parent, if you are looking for your child to have their own spending space and card. Go for Movo Digital Prepaid Visa Card. This, however, might not be the best option if you’re trying to teach the responsibility of spending wisely and creating good saving habits.

See Also: Bulk Credit Card Generator

Contents